Seller Contributions- What you need to know

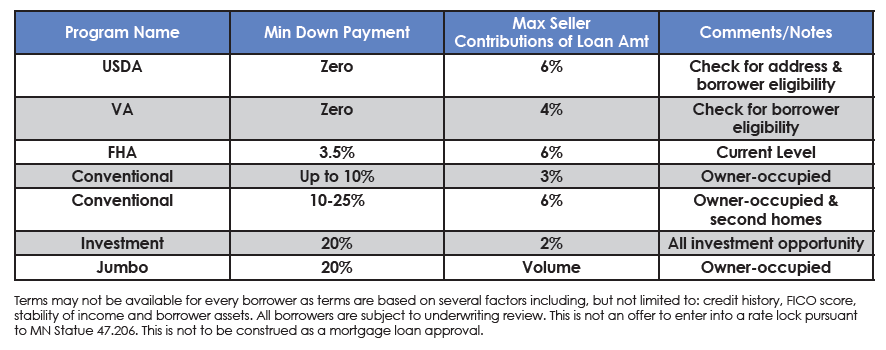

When the seller of a property agrees to contribute money toward the buyer’s closing costs, this is called a “seller contribution.” This is generally done to assist the buyer in closing the loan if they do not have sufficient funds to cover both the down payment and the closing costs. Seller contributions are generally permitted by most lenders, as long as the details are fully disclosed within the sale agreement and the total contribution does not exceed the acceptable limit for that specific loan program. The amount of the contribution can range from the 3% to 6% of the purchase price, depending on the lender’s guidelines, and it cannot exceed the actual amount of closing costs in most cases.

A seller contribution can be a useful bargaining chip to the buyer. Note that the seller’s willingness to contribute will often be driven by current market conditions. If the buyer does not have sufficient funds to pay both the closing costs and the down payment, the seller can increase the cost of the home and make an equal contribution toward closing costs. This is only acceptable if the increased sales price still falls within the appraised value. This money can also be used creatively to pay points to cover closing costs, which are then tax deductible for the buyer.